National Association of REALTORS®

Key Highlights

- Contract signings fell 2.3% in September from August.

- Contract signings were 8% lower than this time last year.

- In all regions, signings decreased from the prior month and from one year ago.

WASHINGTON (October 28, 2021) – Pending home sales dipped in September, nationally, retreating slightly following a previous month of growth, according to the National Association of Realtors®. Each of the four major U.S. regions saw contract activity decline month-over-month and year-over-year, with the Northeast weathering the largest yearly drop.

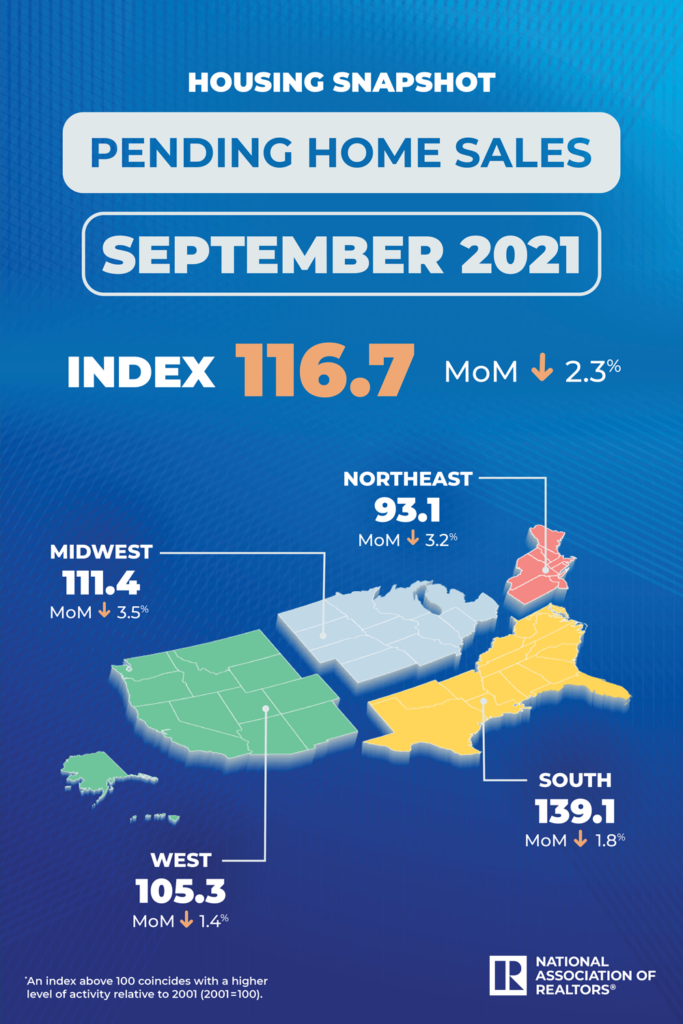

The Pending Home Sales Index (PHSI),* www.nar.realtor/pending-home-sales, a forward-looking indicator of home sales based on contract signings, decreased 2.3% to 116.7 in September. Year-over-year, signings decreased 8.0%. An index of 100 is equal to the level of contract activity in 2001.

“Contract transactions slowed a bit in September and are showing signs of a calmer home price trend, as the market is running comfortably ahead of pre-pandemic activity,” said Lawrence Yun, NAR’s chief economist. “It’s worth noting that there will be less inventory until the end of the year compared to the summer months, which happens nearly every year.

“Some potential buyers have momentarily paused their home search with intentions to resume in 2022.”

Although housing supply remains low, Yun says he expects inventory to turn the corner in 2022.

“Rents have been mounting solidly of late, with falling rental vacancy rates,” Yun said. “This could lead to more renters seeking homeownership in order to avoid the rising inflation, so an increase in inventory will be welcomed.”

Realtor.com®’s Hottest Housing Markets data revealed that out of the largest 40 metros, the most improved metros over the past year, as of October 21, were Orlando-Kissimmee-Sanford, Fla.; Jacksonville, Fla.; Tampa-St. Petersburg-Clearwater, Fla.; Nashville-Davidson-Murfreesboro-Franklin, Tenn.; and Denver-Aurora-Lakewood, Colo.

Once all home sale data has been tabulated by year’s end, NAR expects home sales to have risen by 6.4% in 2021; and due to higher anticipated mortgage rates, NAR projects sales to then decline by 1.7% in 2022. Yun says home prices will moderate with only 2.8% growth in 2022 after a double-digit price gain of 14.7% in 2021.

September Pending Home Sales Regional Breakdown

Month-over-month, the Northeast PHSI fell 3.2% to 93.1 in September, an 18.5% decline from a year ago. In the Midwest, the index dropped 3.5% to 111.4 last month, down 5.8% from September 2020.

Pending home sales transactions in the South decreased 1.8% to an index of 139.1 in September, down 5.8% from September 2020. The index in the West declined 1.4% in September to 105.3, down 7.2% from a year prior.

*The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.

Pending contracts are good early indicators of upcoming sales closings. However, the amount of time between pending contracts and completed sales are not identical for all home sales. Variations in the length of the process from pending contract to closed sale can be caused by issues such as buyer difficulties with obtaining mortgage financing, home inspection problems, or appraisal issues.

The index is based on a sample that covers about 40% of multiple listing service data each month. In developing the model for the index, it was demonstrated that the level of monthly sales-contract activity parallels the level of closed existing-home sales in the following two months.

An index of 100 is equal to the average level of contract activity during 2001, which was the first year to be examined. By coincidence, the volume of existing-home sales in 2001 fell within the range of 5.0 to 5.5 million, which is considered normal for the current U.S. population.